UPDATE: The Corporate Transparency Act May Still Apply to You

On March 1, a district court judge ruled that the Corporate Transparency Act (CTA) is unconstitutional. However, his decision applied only to the...

1 min read

Teri Grahn, CMI

:

September 18, 2018

Teri Grahn, CMI

:

September 18, 2018

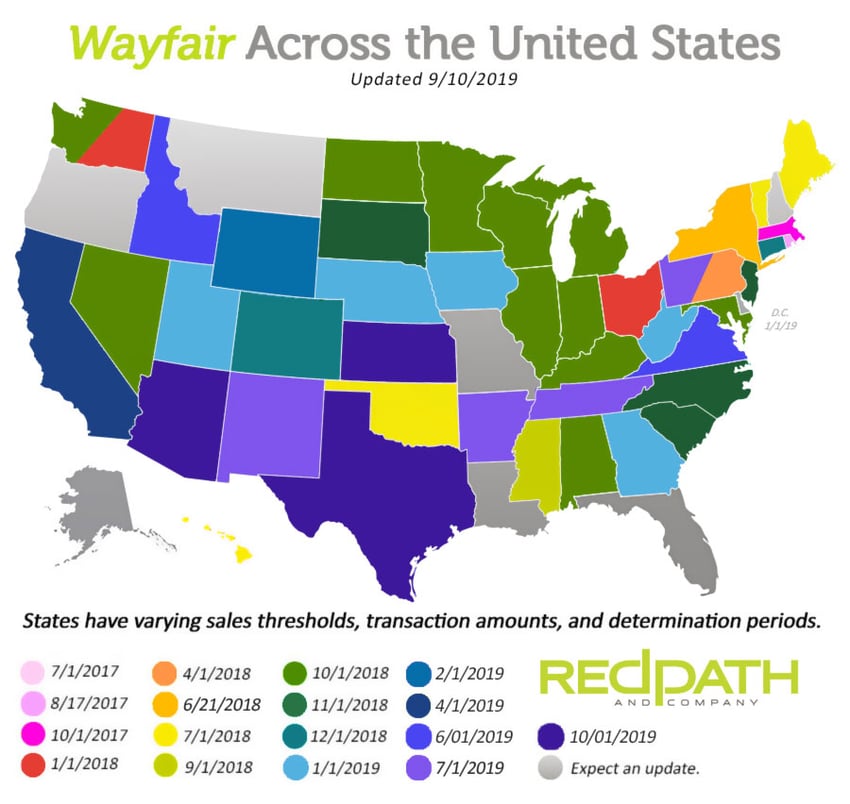

September 18, 2018 —The Supreme Court ruling on South Dakota vs Wayfair last year overturned “Quill”; no longer will physical presence be needed in a state for sales tax collection. The Supreme Court has given the states the power to require businesses to collect their sales tax, just by having a certain amount of sales in a state. Physical presence still creates nexus but is no longer needed.

A company will need to determine if they exceed the economic nexus thresholds that the Supreme Court ruled were acceptable. The ruling in South Dakota is:

If a remote/out of state seller has either $100,000 of sales or 200 transactions in the previous year or the current year they will be required to register, collect and remit South Dakota’s sales tax.

With this decision, there are currently about 40 other states that have similar laws requiring remote, out-of-state retailers to collect sales tax, that are either effective now or within a few months. We expect most other states to pass similar thresholds as soon as they can.

For example, Minnesota had an October 1st effective date; one it shared with Illinois, Indiana, North Dakota, and Wisconsin (among others). Here is a visual of the states and effective dates:

We would love to go through everything you need to know for your specific situation including details about effective dates, thresholds, determination time periods, and instances of pending litigation for all of the different states that apply to you.

On March 1, a district court judge ruled that the Corporate Transparency Act (CTA) is unconstitutional. However, his decision applied only to the...

Bookkeeping is strategically important for every business because financials form the foundation for daily operations and future planning....

In a decision issued March 1, 2024, U.S. District Court Judge Liles Burke ruled that the Corporate Transparency Act (CTA) is unconstitutional....