UPDATE: The Corporate Transparency Act May Still Apply to You

On March 1, a district court judge ruled that the Corporate Transparency Act (CTA) is unconstitutional. However, his decision applied only to the...

1 min read

Redpath and Company

:

December 16, 2020

Redpath and Company

:

December 16, 2020

December 16, 2020 - The Families First Coronavirus Response Act (FFCRA), signed into law by President Trump in March 2020, requires certain employers to provide employees with paid sick leave and expanded family and medical leave for reasons related to COVID-19. The Act, administered by the U.S. Department of Labor, contains a provision for a payroll tax credit taken on IRS Form 941 by the employer.

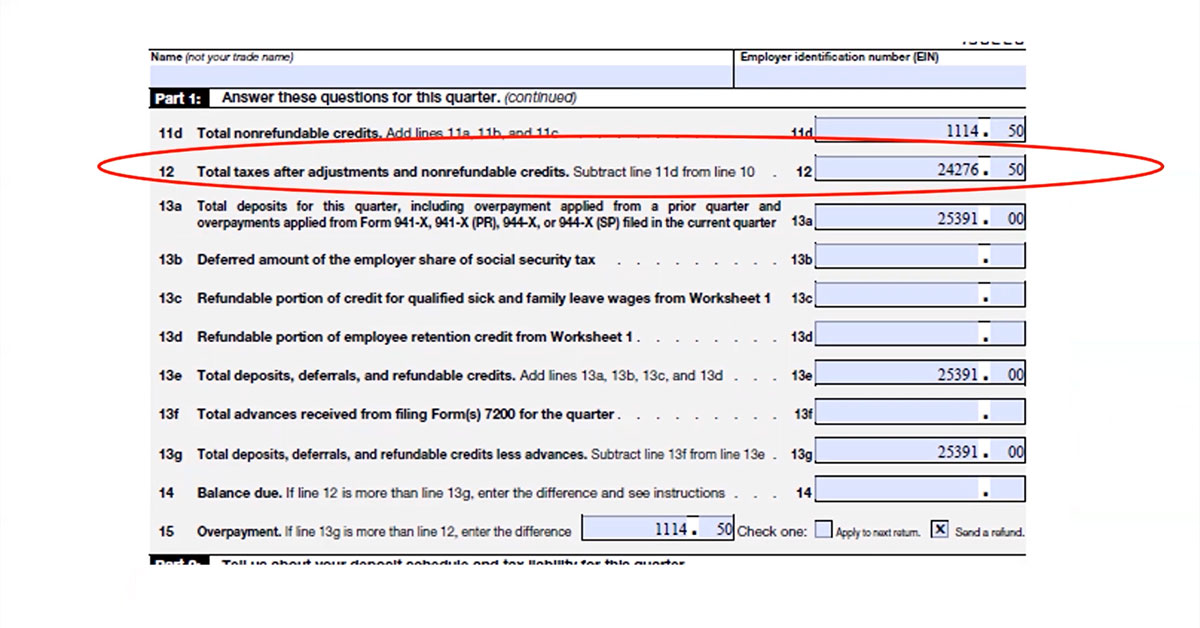

The payroll tax credit, administered by the Internal Revenue Service, provides covered employers a dollar for dollar reimbursement for all qualifying wages paid under FFCRA, the portion of employer Medicare Tax paid on the qualifying wages and qualifying health insurance expense as it relates to the employee on leave. The three-part credit is applied against the employer’s payroll tax liability on Form 941.

In this video, Heather Larson, CPP provides an overview of why the FFCRA is relevant now and opportunities that you may have missed, including a review of areas to pay close attention to on Form 941 starting at two minutes and fifteen seconds. If you have further questions upon completing the video, we encourage you to reach out to your tax planning advisor for further assistance.

On March 1, a district court judge ruled that the Corporate Transparency Act (CTA) is unconstitutional. However, his decision applied only to the...

Bookkeeping is strategically important for every business because financials form the foundation for daily operations and future planning....

In a decision issued March 1, 2024, U.S. District Court Judge Liles Burke ruled that the Corporate Transparency Act (CTA) is unconstitutional....