UPDATE: The Corporate Transparency Act May Still Apply to You

On March 1, a district court judge ruled that the Corporate Transparency Act (CTA) is unconstitutional. However, his decision applied only to the...

2 min read

Jill Noack, CPA

:

July 7, 2021

Jill Noack, CPA

:

July 7, 2021

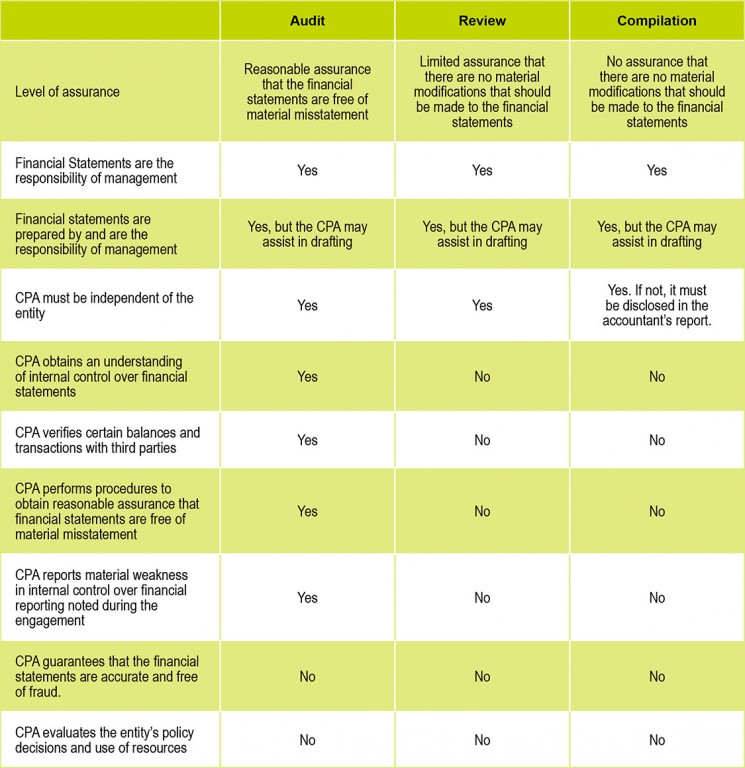

July 7, 2021 - CPAs produce reports that provide different levels of assurance regarding the information contained in the financial statements of their clients. The clients’ lenders, investors, and shareholders (or other users of financial information) will experience varying levels of comfort from those reports based on the type of service performed by the CPA. In order to identify the type of service that is right for your organization, it’s critical to understand the significant differences and nuances in the three general levels of financial statement services available: compilation, review, and audit.

In a compilation engagement, the CPA does not provide any assurance about whether material changes to the financial statements are needed in order for the financial statements to be in conformity with accounting standards. The CPA applies their accounting and financial reporting expertise to assist management in the presentation of financial statements. The CPA does not verify the accuracy or completeness of the information provided by management, and the CPA does not dig into the numbers unless they become aware that information provided by management is an error or incomplete.

In a review engagement, the CPA provides limited assurance about whether material changes to the financial statements are needed in order for the financial statements to be in conformity with accounting standards. In performing a review, the CPA makes inquiries and performs analytical procedures designed to identify unusual items that may need further explanation by management. A CPA must have an understanding of the industry the entity operates in and knowledge of the entity’s business. However, the CPA does not obtain an understanding of internal control, assess control risk, test accounting records by inspection, observation, confirmation, recalculation, re-performance, or obtain corroborating evidential matter.

In an audit engagement, the CPA provides reasonable assurance (high, but not absolute) about whether the financial statements are free of material misstatement whether due to error or fraud.

Auditors are tasked with designing procedures to provide reasonable assurance that financial statements are free of material misstatement, whether caused by error or fraud. Audit standards require an auditor to specifically identify and assess risks that may result in a material misstatement of the financial statements due to fraud and to respond to the results of the assessment when gathering and evaluating audit evidence. There are two types a fraud that are relevant to the auditor’s consideration of fraud: misstatements resulting from fraudulent financial reporting and misstatement resulting from misappropriation of assets. An auditor is primarily concerned with fraud that causes a material misstatement of the financial statements. As such, the auditor has no responsibility to plan and perform the audit to detect immaterial misstatements due to fraud.

To identify the type of assurance service that is right for you, it’s critical to understand the significant differences between a compilation, a review, and an audit of your organization’s financial statements.

On March 1, a district court judge ruled that the Corporate Transparency Act (CTA) is unconstitutional. However, his decision applied only to the...

Bookkeeping is strategically important for every business because financials form the foundation for daily operations and future planning....

In a decision issued March 1, 2024, U.S. District Court Judge Liles Burke ruled that the Corporate Transparency Act (CTA) is unconstitutional....